Topics Discussed in Lex Fridman Podcast #54 – Lex Fridman & Ray Dalio: Doing something that’s never been done before, Shapers, A Players, Confidence and disagreement, Don’t confuse dilusion with not knowing, Idea meritocracy, Is credit good for society?, What is money?, Bitcoin and digital currency, The economic machine is amazing, Principle for using AI, Human irrationality, Call for adventure at the edge of principles, The line between madness and genius, Automation, American dream, Can money buy happiness?, Work-life balance and the arc of life, Meaning of life.

Lex Fridman Podcast: Conversations about science, technology, history, philosophy and the nature of intelligence, consciousness, love, and power. Lex is an AI researcher at MIT and beyond.

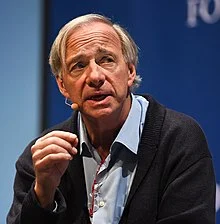

Ray Dalio

Ray Dalio is is an American billionaire investor and hedge fund manager, who has served as co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, since 1985. He founded Bridgewater in 1975 in New York. A $5 million investment from the World Bank's retirement fund was made within five years. His innovations are regarded as some of the best in the industry, having popularized many commonly used practices, such as risk parity, currency overlay, portable alpha and global inflation-indexed bond management. Dalio was born in New York City and attended C.W. Post College of Long Island University before receiving an MBA from Harvard Business School in 1973. Two years later, in his apartment, Dalio launched Bridgewater. In 2013, it was listed as the largest hedge fund in the world. In 2020 Bloomberg ranked him the world's 79th-wealthiest person. Dalio is the author of the 2017 book Principles: Life & Work, about corporate management and investment philosophy. It was featured on The New York Times best seller list, where it was called a "gospel of radical transparency."