Topics Discussed in Lex Fridman Podcast #276 – Lex Fridman & Michael Saylor: Grading our understanding, Inflation, Government, War and power, Dematerializing information, Digital energy and assets, Oil barrel vs Bitcoin, Layers of Bitcoin, Bitcoin’s role during wartime, Jack Dorsey, Bitcoin conflict of interest, Satoshi Nakamoto, Volatility, Bitcoin price, Twitter verification, Second best crypto, Dogecoin, Elon Musk, Advice for young people, Mortality, Meaning of life and much more.

Lex Fridman Podcast: Conversations about science, technology, history, philosophy and the nature of intelligence, consciousness, love, and power. Lex is an AI researcher at MIT and beyond.

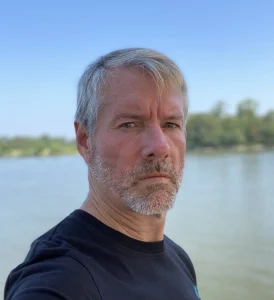

Michael Saylor

Michael Saylor is an American entrepreneur and business executive. He is the executive chairman and a co-founder of MicroStrategy, a company that provides business intelligence, mobile software, and cloud-based services. Saylor served as MicroStrategy's chief executive officer from 1989 to 2022. He authored the 2012 book The Mobile Wave: How Mobile Intelligence Will Change Everything. He is also the sole trustee of Saylor Academy, a provider of free online education. As of 2016, Saylor had been granted 31 patents and had 9 additional applications under review. On MicroStrategy's quarterly earnings conference call in July 2020, Saylor announced his intention for MicroStrategy to explore purchasing Bitcoin, gold, or other alternative assets instead of holding cash. The following month, MicroStrategy used $250 million from its cash stockpile to purchase 21,454 Bitcoin. Michael graduated from MIT in 1987, with a double major in aeronautics and astronautics; and science, technology, and society. Find the books mentioned in Michael Saylor's conversation with Lex Fridman below.

Books Mentioned in this Podcast with Lex Fridman & Michael Saylor:

The Ethical Dimensions of Bitcoin: Property vs. Securities

In the ever-evolving landscape of digital assets, one name stands out prominently – Bitcoin. Often referred to as a cryptocurrency, Bitcoin is more accurately described as a crypto asset due to its unique nature. Beyond its monetary value, Bitcoin has sparked discussions about its ethical implications, particularly in contrast to traditional securities. In this article, we delve into the ethical dimensions of Bitcoin, exploring why it is considered property and how this sets it apart from securities.

The Nature of Property

To understand the ethical nuances surrounding Bitcoin, it’s essential to first grasp the concept of property. Property, in the world of finance and economics, typically denotes assets that are naturally occurring, not under the control of a specific entity or group. These assets include tangible items like real estate, commodities, or even digital properties such as domain names. The key characteristic that distinguishes property is its inherent lack of control by a centralized authority.

The Distinctive Ethical Nature of Bitcoin

Bitcoin aligns itself with the category of property. It is not under the dominion of a single entity or government. Instead, it operates on a decentralized network, which is maintained by a distributed set of computers around the world. This decentralized nature fundamentally sets Bitcoin apart from traditional securities, which are often issued and controlled by specific companies or organizations.

The Ethical Significance of Decentralization

The ethical significance of decentralization cannot be overstated. When an asset is decentralized, it means that it remains immune to manipulation by any one entity or group. It ensures that the asset retains its value and integrity irrespective of the actions or interests of a select few. In the context of Bitcoin, this decentralization is one of its most defining features.

Securities and Ethical Concerns

On the flip side, securities encompass a range of assets that include stocks, bonds, and various crypto tokens. The ethical considerations surrounding securities are inherently different due to their centralized nature. Securities often have distinct governance structures, boards of directors, and CEOs who wield significant influence over the asset’s performance. This control over securities necessitates a set of regulatory oversight and fair disclosure requirements to ensure ethical dealings.

The Conflict of Interest

One of the ethical quandaries associated with securities arises from potential conflicts of interest. When an entity promotes or sells securities, it can potentially manipulate the asset’s value or influence its market performance. This conflict of interest becomes especially pronounced when assets are controlled by a small group or company. Such influence can lead to unethical practices that may harm investors or market participants.

Bitcoin as an Ethical Crypto Asset

In contrast to securities, Bitcoin is often viewed as an ethical crypto asset. Its capped supply of 21 million coins and the absence of centralized control make it akin to property. Bitcoin operates as a common, property-like asset that is not subject to the whims or interests of a select group. This inherent decentralization contributes to its ethical appeal.

Conclusion

The ethical dimensions of Bitcoin are fascinating and deserve thoughtful consideration. It is vital to recognize that Bitcoin’s categorization as property, rather than a security, is grounded in its decentralized nature. This decentralized attribute grants it a distinct ethical standing in the world of digital assets. As discussions about cryptocurrencies continue, understanding these ethical distinctions is crucial for both investors and regulators alike. Bitcoin’s emergence as a decentralized property-like asset has profound implications for the future of finance, paving the way for a new era of ethical and decentralized financial systems.