Back to search

%22%2F%3E%0A%20%20%3Crect%20x%3D%2218%22%20y%3D%2218%22%20width%3D%22204%22%20height%3D%228%22%20rx%3D%224%22%20fill%3D%22%2360a5fa%22%20opacity%3D%220.9%22%2F%3E%0A%20%20%3Crect%20x%3D%2218%22%20y%3D%2240%22%20width%3D%22204%22%20height%3D%222%22%20rx%3D%221%22%20fill%3D%22%2360a5fa%22%20opacity%3D%220.55%22%2F%3E%0A%20%20%3Ctext%20x%3D%2222%22%20y%3D%22194%22%20font-size%3D%2284%22%20font-weight%3D%22700%22%20fill%3D%22%23eff6ff%22%20font-family%3D%22system-ui%2C%20-apple-system%2C%20Segoe%20UI%2C%20sans-serif%22%3ETR%3C%2Ftext%3E%0A%20%20%3Ctext%20x%3D%2222%22%20y%3D%22268%22%20font-size%3D%2218%22%20fill%3D%22%23eff6ff%22%20opacity%3D%220.95%22%20font-family%3D%22system-ui%2C%20-apple-system%2C%20Segoe%20UI%2C%20sans-serif%22%3EThe%20Richest%20Woman%20in%20Ame%3C%2Ftext%3E%0A%20%20%3Ctext%20x%3D%2222%22%20y%3D%22292%22%20font-size%3D%2213%22%20fill%3D%22%23eff6ff%22%20opacity%3D%220.82%22%20font-family%3D%22system-ui%2C%20-apple-system%2C%20Segoe%20UI%2C%20sans-serif%22%3EJanet%20Wallach%3C%2Ftext%3E%0A%3C%2Fsvg%3E)

FoundersDecember 22, 2019

#103 Hetty Green (The Richest Woman in America)

Listen

About This Episode

What I learned from reading The Richest Woman in America: Hetty Green in the Gilded Age by Janet Wallach. ---- [0:10] She was the smartest woman on Wall Street, a financial genius, a railroad magnate, a real estate mogul, a Gilded Era renegade, a reliable source for city funds. [0:19] “I have had fights with some of the greatest financial men in the country. Did you ever hear of any of them getting ahead of Hetty Green?” [1:10] I go my own way, take no partners, risk nobody else’s fortune. [1:29] She was considered the single biggest individual financier in the world. [1:58] A Mind at Play: How Claude Shannon Invented the Information Age by Jimmy Soni and Rob Goodman (Founders #95) [2:55] Watch your pennies and the dollars will take care of themselves. [3:31] Don’t close a bargain until you have reflected on it overnight. [4:00] I am always buying when everyone wants to sell, and selling when everyone wants to buy. [4:51] I never set out for anything that I don’t conquer. [5:55] To live content with small means; To seek elegance rather than luxury, And refinement rather than fashion; To be worthy, not respectable, and wealthy, not rich. [7:27] Her father’s advice: Never owe anyone anything. [9:44] By the time she is 13 she is the family bookkeeper. [11:53] She paid attention when he (her father) repeated again and again that property was a trust to be taken care of and enlarged for future generations. She obeyed when he insisted that she keep her own accounts in order and later praised the experience. “There is nothing better than this sort of training,” she said. [13:28] Hetty hungered for money itself. [14:08] List of financial panics discussed in the book: Panic of 1857, Panic of 1866, The Long Depression 1873-1896 which had several panics within, (Panic of 1873, 1884, 1890, 1893) Panic 1901 and Panic of 1907. [16:18] She was a master at studying what happened before her. [16:31] The First Tycoon: The Epic Life of Cornelius Vanderbilt by TJ Stiles. (Founders #54) and Tycoon's War: How Cornelius Vanderbilt Invaded a Country to Overthrow America's Most Famous Military Adventurer by Stephen Dando-Collins (Founders #55) [17:15] Clever men like Russell Sage, a future role model for Hetty, kept substantial amounts of cash on hand and used it to buy stocks at rock-bottom prices. John Pierpont Morgan told his son there was a good lesson to be learned from other people’s greed and good bargains to be found in the aftermath. In future times, Hetty would always keep cash available and use it to buy when everyone else was selling. Much later, Warren Buffett would do the same. But most people watched their money wash away in the flood. [23:57] This was the start of the contrary investing she followed for the rest of her life: buying when everyone else was selling; selling when everyone else was buying. “I buy when things are low and nobody wants them. I keep them until they go up and people are crazy to get them. That is, I believe, the secret of all successful business,” she said. [26:46] Hetty, like Claude Shannon, Warren Buffett, and Ed Thorp, collected a lot of information. Hetty read more and studied more than most other people. [28:07] The opportunities were enormous for those with the stomach to take the risks. [30:25] The markets may change, the methods may be revamped, but as long as human beings are propelled by greed and ego, they are doomed to repeat the mistakes of the past. [31:11] She had a pile of cash when others were scouring for pennies, but she also had a deft mind and the colossal courage to push against the crowd. [36:17] Hetty’s investments were not always known: she purchased property under fictitious names, bought stocks under other identities, and was praised by shrewd observers for how closely she held her positions. [37:41] Williams greeted his new customer with all the courtesy and respect due a woman of her wealth. “I have observed that many a tattered garment hides a package of bonds and that gorgeous clothing does not always cover a millionaire,” he told his colleagues. [44:14] The Fish That Ate the Whale: The Life and Times of America's Banana King by Rich Cohen (Founders #37) [45:52] Hetty didn't like the idle rich. She respected authentic achievement. [48:48] Companies who stocks had skyrocketed collapsed when their lack of capital was revealed. [49:22] The HP Way: How Bill Hewlett and I Built Our Company by David Packard. (Founders #29) [49:30] More companies die from indigestion than starvation. —David Packard [50:58] She used her intelligence to increase her wealth, her independence to live as she wished, and her strength to battle anyone who stood in her way. [55:24] They sought her out to sell off their possessions. As rates rose, more and more of “the solidest men in Wall Street,” she said, from “financiers to legitimate businessmen,” came to call, begging to unload everything from palatial mansions to automobiles. “They came to me in droves,” she recalled. [59:30] When it comes to spending your life, there have to be some things neglected. If you try to do too much, you can never get anywhere. [59:53] You see this advice over and over again. You just got to figure out what that thing is that you want to focus on. No one can answer that question for you. [1:00:14] I think the key to a happy life is getting to the end of your life with the least amount of regrets as possible. [1:00:24] She prized the life she led. “I enjoy being in the thick of things. I like to have a part in the great movements of the world and especially of this country. I like to deal with big things and with big men. I would rather do [this] than play bridge. Indeed, my work is my amusement, and I believe it is also my duty.” ---- Founders Notes gives you the ability to tap into the collective knowledge of history's greatest entrepreneurs on demand. Use it to supplement the decisions you make in your work. Get access to Founders Notes here. ---- “I have listened to every episode released and look forward to every episode that comes out. The only criticism I would have is that after each podcast I usually want to buy the book because I am interested so my poor wallet suffers. ” — Gareth Be like Gareth. Buy a book: All the books featured on Founders Podcast

Book Mentions

4 book mentions in this episode.

Jump to booksTip: Click “Mentioned at …” to copy a timestamp.

Tip: Click a cover image to open a book link.

Books Mentioned

“The speaker discusses the book they read about Hedy Green, highlighting her life and financial acumen.”

Sentiment: Highly Recommended

Trigger: Hedy Green's investment strategies

For: Individuals interested in investing and financial history

Key quote: “My calculus was rather simple. Claude Shannon was really smart. And if he learned from Hedy Green, why wouldn't I.”

The host mentions this book to highlight Hedy Green's unique approach to wealth and investment, contrasting her methods with those of her contemporaries. The host draws a connection between Green's financial wisdom and the learning journey of Claude Shannon, suggesting that her insights are valuable for anyone interested in investing.

ASIN: N/A

Buy on AmazonClick the book cover image to open the affiliate link.

“The speaker mentions reading 'A Mind at Play' which discusses Claude Shannon and his interest in Hedy Green.”

Sentiment: Highly Recommended

Trigger: Claude Shannon's investment strategies

For: Individuals interested in investing and financial history

Key quote: “Claude Shannon was really smart. And if he learned from Hedy Green, why wouldn't I.”

The host mentions 'A Mind at Play' to highlight Claude Shannon's approach to learning about investing through studying successful investors like Hedy Green. This connection emphasizes the value of learning from historical figures in finance to enhance one's own investment acumen.

ASIN: 144568277X

Buy on AmazonClick the book cover image to open the affiliate link.

“Hedy wanted to trade during the panic of 1873, believing in getting in at the bottom and out at the top. She often said she liked to buy railroad stock or mortgage bonds when they were cheap.”

Sentiment: Highly Recommended

Trigger: Hedy Green's financial legacy

For: Readers interested in financial history and women's contributions to business

Key quote: “Her formula for success was simple. Common sense and hard work.”

The host mentions Hedy Green to highlight her unique approach to wealth and independence during the Gilded Age. The book 'The Richest Woman in America, Hedy Green in the Gilded Age' by Janet Wallach provides an insightful exploration of her life and financial strategies.

ASIN: N/A

Buy on AmazonClick the book cover image to open the affiliate link.

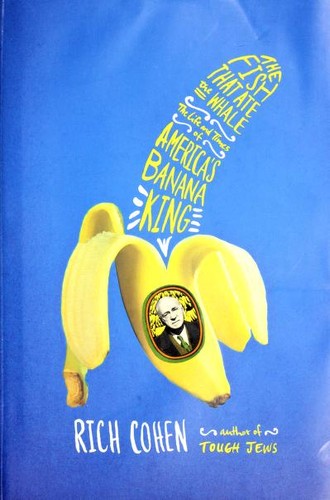

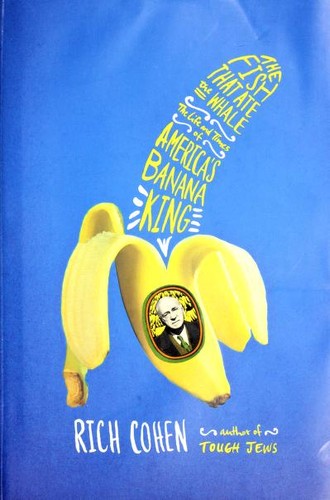

“The book discusses the journey of a penniless immigrant who became wealthy by studying the banana industry, emphasizing the importance of knowing your business thoroughly.”

Sentiment: Highly Recommended

Trigger: Hedy's investment strategies

For: Individuals interested in business and investment strategies

Key quote: “But the quote in the book is like, listen, if you know your business from A to Z, there's no problem you can't solve.”

The host mentions 'The Fish That Ate The Whale' to highlight Hedy's belief in understanding the fundamentals of business, particularly in the railroad industry. This book illustrates the journey of a penniless immigrant who became wealthy through knowledge and hard work, which Hedy wanted to instill in her son.

ASIN: N/A

Buy on AmazonClick the book cover image to open the affiliate link.