Benchmark Part I

Books Mentioned

“Bob reads Jim Collins' book 'Built to Last' and aligns its principles with his vision for the future fund, using it as a marketing tool while pitching to LPs.”

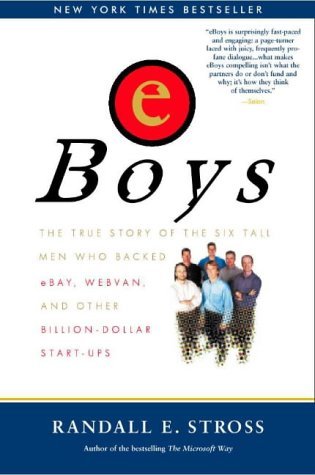

“It is the authorized history of benchmark up until 2000, where the author actually sat with the partners for the better part of two years, fully sanctioned to observe conversations in partner meetings.”

“Randall Strauss had written at that point, Steve Jobs and the next big thing about next. The tagline on the book was the first inside account of venture capitalists at work.”

“This is like the Go Corporation of which Jerry Kaplan wrote the great book Startup about.”

“The whole recruitment process, all the internal discussions about Bill are chronicled in E-Boys. It's dramatized, but there's a discussion about Bill that screamed off the page to me.”

“The speaker mentions reading 'The Hard Thing About Hard Things' and expresses excitement about meeting Eric Mistrya, who worked with Ben Horowitz.”