Renaissance Technologies

Books Mentioned

“The great example that Greg Zuckerman gives in the book is yes a baseball game there's three balls and two strikes that state has a narrow set of states after it...”

“In Greg's book, he greatly points out this perfect example. When I say apple, you might say pie. The probability that pie is going to be the next word following apple is significantly higher.”

“I am going to read directly from the man who solved the market because Greg Zuckerman just put it perfectly. Basket options are financial instruments whose values are pegged to the performance of a specific basket of stocks.”

“This is Hamilton Helmer's framework from the book, Seven Powers. What is it that enables a business to achieve persistent differential returns to be more profitable than their closest competitor on a sustainable basis?”

“The mention of 'flash boys' refers to high frequency traders who are front running trades, as discussed in the context of trading strategies.”

“Medallion is referenced in the context of trading strategies, specifically in the slow and smart quadrant of trading execution.”

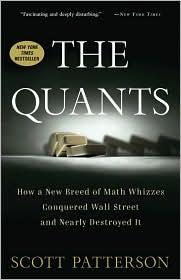

“A book from 2011 that covers some aspects of Rentech, though not as updated as The Man Who Solved the Market.”